Income Tax Rates 2025/24 Uk

BlogIncome Tax Rates 2025/24 Uk - Tax Brackets 2025 Uk Yetty Kristy, The standard personal allowance is £12,570, which is the. Uk income tax rates and bands (excluding scotland) this table shows the bands and tax rates for 2025/25, compared to the 2025/24 tax year. Summertime Ball 2025 Last year, the pop music. Poppie platt…

Tax Brackets 2025 Uk Yetty Kristy, The standard personal allowance is £12,570, which is the. Uk income tax rates and bands (excluding scotland) this table shows the bands and tax rates for 2025/25, compared to the 2025/24 tax year.

2025 Tax Brackets Chart By State Adora Patrica, The basic rate of income tax is 20%, which applies to income between £13,001 and £50,270. Here’s a breakdown of how it’s calculated:

This increased to 40% for your earnings above £50,270 and to 45% for earnings over £150,000.

New Capital Gains Tax 2025 Uk Elset Horatia, Scottish taxpayers will see the introduction of a new “advanced”. In this article we look at all of the new tax rates for the 2025/25 tax year including income tax, the personal allowance, and national insurance.

Euro 2025 Matchs Belgique Eurosport est votre source privilégiée pour…

2025 Tax Code Changes Everything You Need To Know RGWM Insights, A full breakdown of the tax rates and thresholds for the 2025/2025 tax year in england, northern ireland, scotland and wales with a downloadable pdf. This increased to 40% for your earnings above £50,270 and to 45% for earnings over £150,000.

Tax rates for the 2025 year of assessment Just One Lap, Use the 2025 income tax and personal allowances to calculate tax commitments, self assessment tax returns in 2025, 2025 salary calculations, dividend allowances In this article we look at all of the new tax rates for the 2025/25 tax year including income tax, the personal allowance, and national insurance.

2025 Personal Tax Rates in Europe Tax Foundation, In this article we look at all of the new tax rates for the 2025/25 tax year including income tax, the personal allowance, and national insurance. The basic rate (20%), the higher rate (40%), and.

Tax Bracket 2025 Calculator Lucky Roberta, Uk income tax rates and bands (excluding scotland) this table shows the bands and tax rates for 2025/25, compared to the 2025/24 tax year. Income tax rates for individuals.

2025 Tax Brackets Formula Emelia, Lowering the average tax rate on income. A guide to the tax brackets and tax rates for the 2025/25 tax year, including income tax rates, national insurance and corporation tax.

The basic rate (20%), the higher rate (40%), and. The effective personal tax rate is defined as the employee national insurance and income tax paid as a proportion of an.

2025 Ascent Subaru Review Start here to discover how much…

The basic rate of income tax is 20%, which applies to income between £13,001 and £50,270.

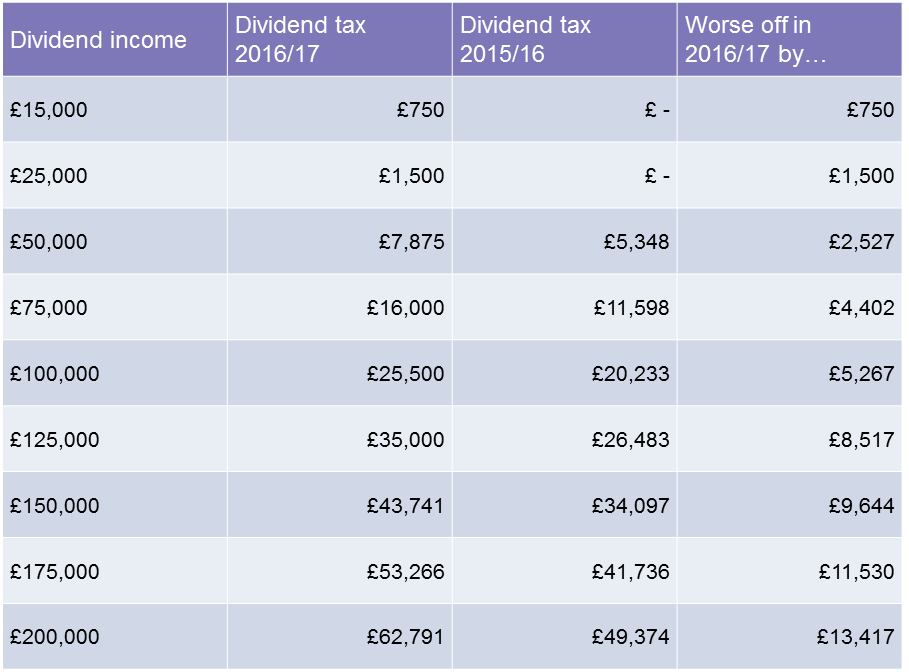

How To Calculate Uk Dividend Tax Haiper, Income tax thresholds and the annual personal allowance remain unchanged and frozen. 0% tax on earnings up to £12,570.

The pa is set at £12,570 up to and including 2025 to 2026.

In this article we look at all of the new tax rates for the 2025/25 tax year including income tax, the personal allowance, and national insurance. Use the 2025 income tax and personal allowances to calculate tax commitments, self assessment tax returns in 2025, 2025 salary calculations, dividend allowances

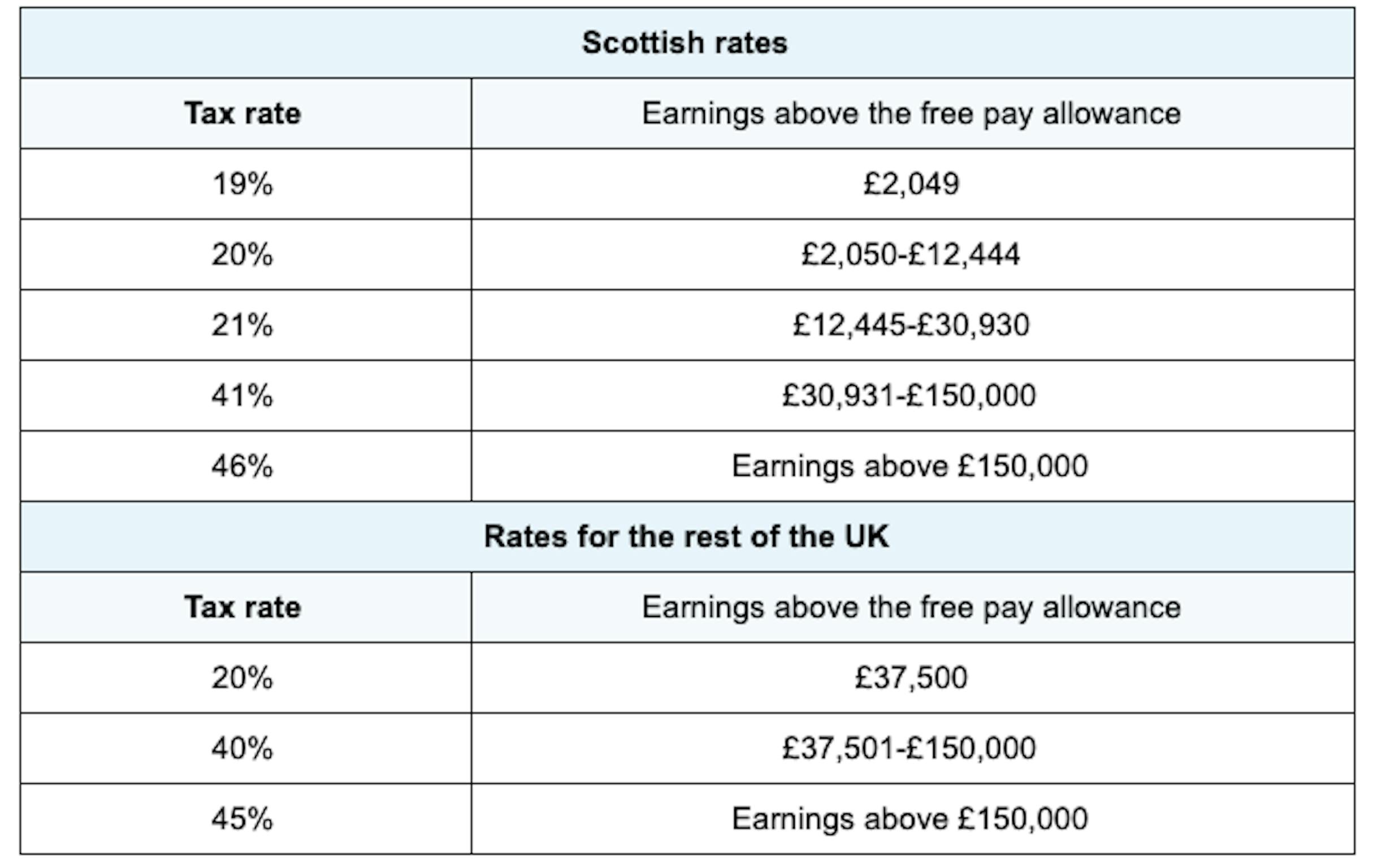

This interactive chart lets you see the current ruk and scottish marginal tax rates for 2025/24 and 2025/25, with/without child benefit and student loans.

Uk Tax Brackets 2025/24 Caro Martha, This interactive chart lets you see the current ruk and scottish marginal tax rates for 2025/24 and 2025/25, with/without child benefit and student loans. Scottish taxpayers will see the introduction of a new “advanced”.